Starting with the 2012 / 2013 tax season our W2 Mate software supports Bulk TIN Matching (complies with IRS Publication 2108A).

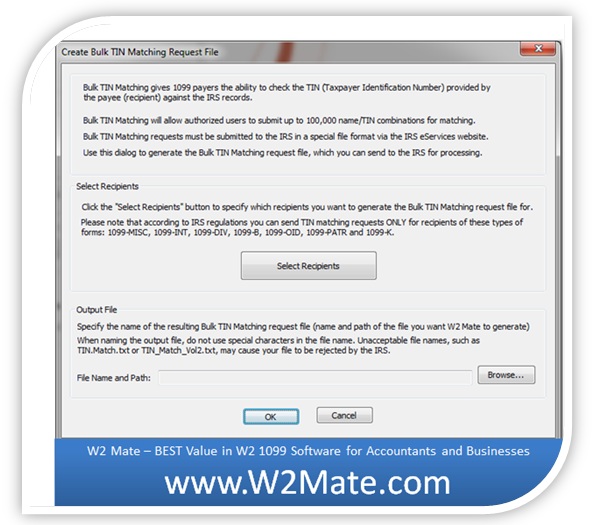

Bulk TIN Matching gives 1099 payers the ability to check the TIN (Taxpayer Identification Number) provided by the payee (recipient) against the IRS records.

Bulk TIN Matching will allow authorized users to submit up to 100,000 name/TIN combinations for matching.

Bulk TIN Matching requests must be submitted to the IRS in a special file format via the IRS eServices website.

You can use W2 Mate software to generate the Bulk TIN Matching request file, which you can send to the IRS for processing.

Within 24 hours of sending a Bulk TIN Matching request to the IRS, the submitter will receive a response file, which indicates the status of each TIN/Name combination.

You can use W2 Mate software to read and analyze the Bulk TIN Matching response file you receive from the IRS e-Services website. W2 Mate will break down the results in an easy to ready format.

Our Bulk TIN Matching software is available for immediate download from our website by clicking the link below:

The Bulk TIN Matching feature inside W2 Mate software are 1099 filers issuing Form 1099 Statements of Income for Recipients of Proceeds from:

» Merchant Card Third Party Network Payments (1099-K)

» Real Estate Brokers and Barter Exchange Transactions (1099-B)

» Dividends and Distributions (1099-DIV)

» Interest Income (1099-INT)

» Miscellaneous Income (1099-MISC)

» Original Issue Discount (1099-OID)

» Taxable Distributions Received from Cooperatives (1099-PATR)

Visit 1099 software page to learn more and for free download.