1099 A Software : File 1099 Abandoned Property

If you are a bank, lending company or some other financial institution you are required by the Internal Revenue Service to file Form 1099-A, Acquisition or Abandonment of Secured Property, for each borrower if you lend money in connection with your business, you acquire an interest in property that is security for the debt, or you have reason to know that the property has been abandoned.

W2 Mate is a powerful W2 / 1099 software that supports a number of 1099 forms other than 1099-A. This page is dedicated to 1099-A, to read about the full capabilities of W2 Mate click here .

Start printing now...Order our 1099-A Software and receive instantly!

Our 1099 A Software prints the following copies on blank paper with black ink:

1099-A Copy B : For Borrower.

1099-A Copy C : For Lender.

Our 1099A Software prints ON the following official IRS laser forms:

Laser Copy A of form 1099 Abandoned Property: For Internal Revenue Service Center.

Laser 1096 form : Annual Summary and Transmittal of U.S. Information Returns.

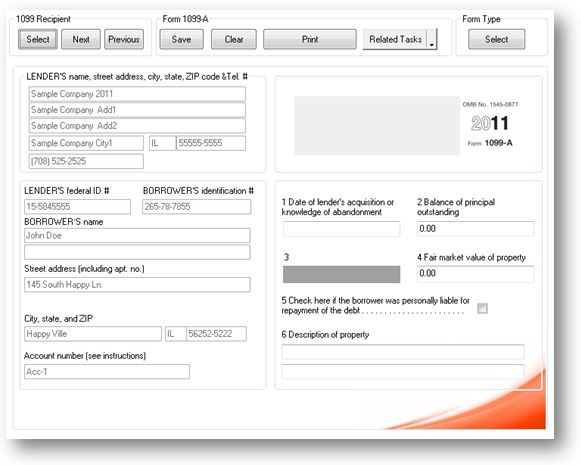

Below is a screenshot of our 1099 Abandonment of Secured Property Software:

1099-A QuickBooks | 1099 Abandonment and QuickBooks

Although QuickBooks software from Intuit only supports 1099 Miscellaneous forms, our 1099-A software allows QuickBooks users import 1099 data and then map it into 1099-A forms with the ability to specify which box the money amount goes to. For example the user can remap QuickBooks 1099-MISC amounts stored under 1099-MISC Box 7 (Nonemployee compensation) into 1099-A Box 2 Balance of principal outstanding. Banks and other financial institutions that use QuickBooks to track 1099A payments can also W2 Mate software to print borrower copies, IRS copies, e-file through IRS FIRE System and much more.

Dynamics GP 1099A| Great Plains Form 1099-A

Many commercial banks, trust companies, credit unions and other US lending institutions use Microsoft Dynamics (Great Plains) to track form 1099-A information including date of lender's acquisition or knowledge of abandonment and balance of principal outstanding. Since Microsoft Dynamics does not support printing and/or E-filing 1099A forms, our W2 Mate software can import data from Dynamics and then allow the user to print borrower copies on regular white paper, IRS copy A on pre-printed forms and if required generate 1099-A electronic filing submission for reporting electronically through IRS FIRE system.