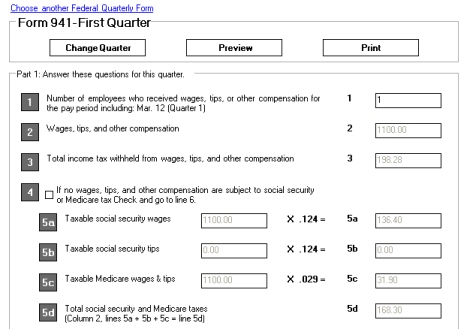

Payroll Mate automatically prepares form 941 (Employer’s QUARTERLY Federal Tax Return). The 941 screen allows the user to edit, preview and print this important tax form.

Form 941 is used to report the employer's tax and payroll deposits for each quarter of the tax year. This payroll form is due four times each year( April 30th, July 31st, October 31st and January 31st). Our payroll software program makes preparing and filing this form easy and hassle free.

Download Now!

Test Drive Our Payroll Tax Software

Click Here

Our Payroll solution calculates wages, salaries, bonuses, user-defined income types, tax withholdings (such as Federal and Social Security), user-defined tax types and deductions. Our payroll software also prints payroll checks (paycheck and the pay stub), generates payroll forms and comprehensive easy-to-follow reports.

So if you are trying to know how to prepare 941 form or looking for form 941 generator then Payroll Mate software is the right solution for you.

Order Now!

Buy Our 941 Payroll Software for $219

only!

Click Here

or Click here to download our Payroll Software Now.