Thanks to our one-click import feature from Peachtree, users can import complete employees' payroll setup, names, addresses and other information in no time. Below is a summary of the import process:

Questions? 1-800-507-1992 or sales@realtaxtools.com

Payroll Software Free Trial Learn More about our Payroll SoftwareOur payroll software allows for exporting payroll data to Sage Peachtree in easy to follow steps:

Questions? 1-800-507-1992 or sales@realtaxtools.com

Download Free Trial Payroll Software Details

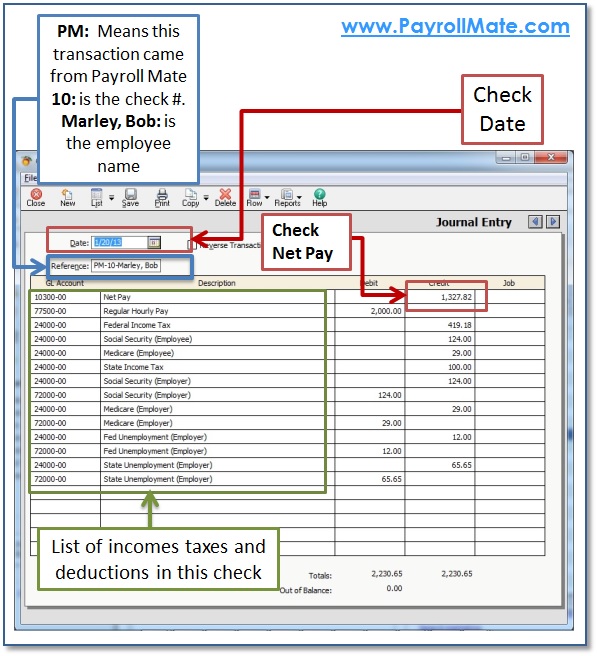

The screenshot below shows a sample general ledger entry for a payroll check exported from Payroll Mate to Peachtree software.

Live Chat

sales@realtaxtools.com

1-800-507-1992

info@realtaxtools.com

1-708-479-8731

Real Business Solutions

18313 Distinctive Drive

Orland Park, IL USA 60467

Real Business Solutions was founded in the state of Illinois in 2003.

support@realtaxtools.com

1-708-479-8731

Fax: 1-708-590-0910

In 2013, we celebrated our 10th Anniversary

© Copyright 2015 Real Business Solutions. All Rights Reserved. Please review our privacy statement and terms of use. Uninstall Instructions. Return Policy

Disclaimer: The information on our site is for educational purposes only and is not intended to be legal or tax advice. Real Business Solutions makes no guarantees as to the validity of the information presented. Your particular facts and circumstances, and changes in the law, must be considered when applying United States tax law.